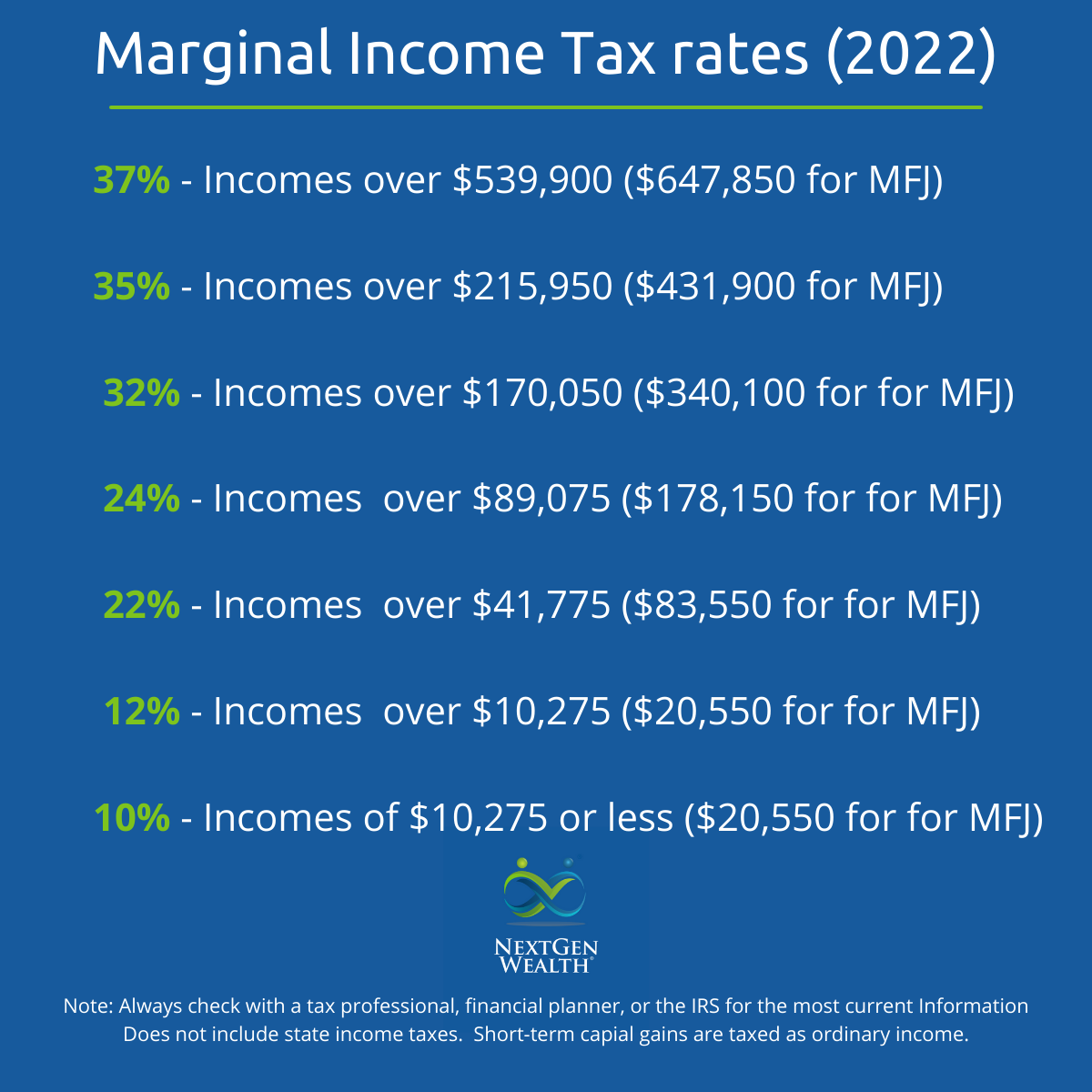

Tax Bracket 2025 Mfj. The 2025 federal tax brackets apply to your income in 2025, which you’ll report on the tax return that’s due in april 2025, or october 2025 with an extension. Wondering about 2025 tax brackets and how they’ll affect your tax?

Your bracket depends on your taxable income and filing status. Learn how marginal tax rates work, see tables for all filing statuses, and understand changes.

Tax Brackets 2025 Vs 2026 Image to u, Filing jointly has many tax benefits, as the irs and many states effectively double the width of most mfj brackets when compared to the single tax bracket at the same tax rate level.

Tax 2025 Kacy Elisabeth, See current federal tax brackets and rates based on your income and filing status.

2025 Standard Deduction Mfj Vs Single Lynea Rosabel, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation.

New Tax Brackets For 2025 Filing Taxes Retha Charline, And is based on the tax brackets of 2025 and.

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Tax Brackets For 2025 Married Filing Jointly at Julian Pryor blog, Your filing status and taxable.

2025 Tax Brackets Mfj Alfy Clementine, The income tax calculator estimates the refund or potential owed amount on a federal tax return.

2025 Tax Brackets And Standard Deduction Evie Oralee, See current federal tax brackets and rates based on your income and filing status.

2025 Standard Deduction Mfj Over 65 Astra Candace, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Best Suv 2025 Luxury India. Here are the upcoming suv launches and updates from top automakers in india. Mg motor[...]

Atp 250 Brisbane 2025. Official atp tennis results and scores for men's professional tennis tournaments on the atp tour. Let’s[...]

Happy New Year Images 2025 Free Download 2025. 33,902 free images of new year 2025. Download these happy new year[...]